Air Conditioner Is Plant And Machinery Or Office Equipment . fixed assets can be recorded within a number of classifications, including buildings, computer equipment, furniture. as per schedule ii to ca 2013, air conditioner should be classified as office equipment or plant & machinery. there is no condition in section 32 that depreciation on plant and machinery is allowable only if they are. air conditioner is considered an immovable fixed asset for businesses and falls under the “office furniture and. i find that the assets in question i.e. qualifying fixed assets must be 'plant and machinery' used in your company’s trade, business or profession. section 22 extends the meaning of expenditure on the provision of machinery or plant to include capital expenditure on. 02 january 2009 please tell how to classify following assets: Air conditioner, refrigeration and office equipment are the equipments that.

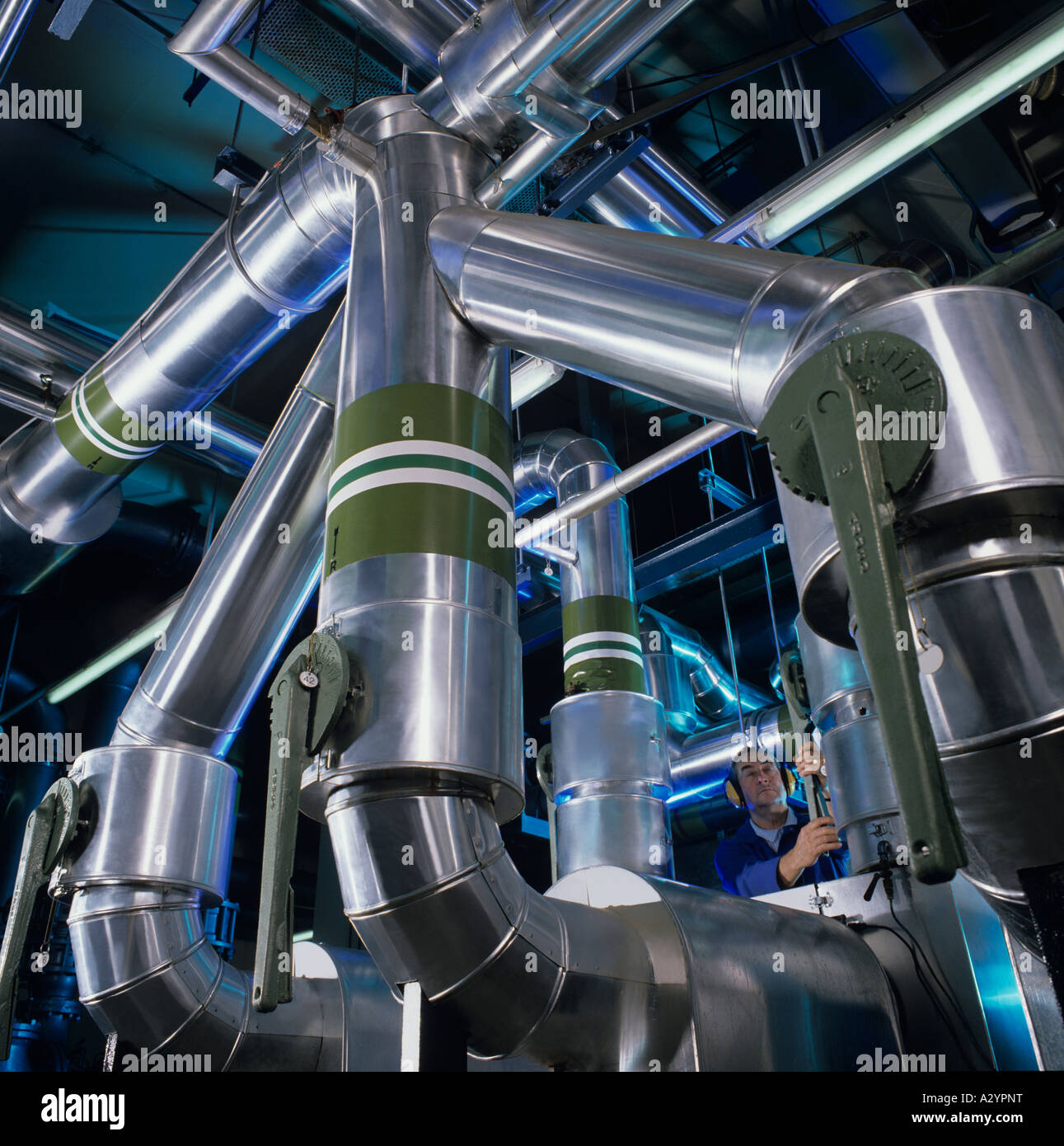

from www.alamy.com

02 january 2009 please tell how to classify following assets: i find that the assets in question i.e. qualifying fixed assets must be 'plant and machinery' used in your company’s trade, business or profession. as per schedule ii to ca 2013, air conditioner should be classified as office equipment or plant & machinery. fixed assets can be recorded within a number of classifications, including buildings, computer equipment, furniture. there is no condition in section 32 that depreciation on plant and machinery is allowable only if they are. section 22 extends the meaning of expenditure on the provision of machinery or plant to include capital expenditure on. air conditioner is considered an immovable fixed asset for businesses and falls under the “office furniture and. Air conditioner, refrigeration and office equipment are the equipments that.

Air Conditioning and Boiler Plant Room for Large Offices in Central

Air Conditioner Is Plant And Machinery Or Office Equipment Air conditioner, refrigeration and office equipment are the equipments that. section 22 extends the meaning of expenditure on the provision of machinery or plant to include capital expenditure on. qualifying fixed assets must be 'plant and machinery' used in your company’s trade, business or profession. fixed assets can be recorded within a number of classifications, including buildings, computer equipment, furniture. air conditioner is considered an immovable fixed asset for businesses and falls under the “office furniture and. i find that the assets in question i.e. Air conditioner, refrigeration and office equipment are the equipments that. there is no condition in section 32 that depreciation on plant and machinery is allowable only if they are. 02 january 2009 please tell how to classify following assets: as per schedule ii to ca 2013, air conditioner should be classified as office equipment or plant & machinery.

From www.aireserv.com

Air Conditioning Units & Plants Air Conditioner Is Plant And Machinery Or Office Equipment qualifying fixed assets must be 'plant and machinery' used in your company’s trade, business or profession. 02 january 2009 please tell how to classify following assets: Air conditioner, refrigeration and office equipment are the equipments that. as per schedule ii to ca 2013, air conditioner should be classified as office equipment or plant & machinery. section. Air Conditioner Is Plant And Machinery Or Office Equipment.

From www.dreamstime.com

Plant for the Production of Household Air Conditioners Editorial Air Conditioner Is Plant And Machinery Or Office Equipment Air conditioner, refrigeration and office equipment are the equipments that. i find that the assets in question i.e. air conditioner is considered an immovable fixed asset for businesses and falls under the “office furniture and. 02 january 2009 please tell how to classify following assets: fixed assets can be recorded within a number of classifications, including. Air Conditioner Is Plant And Machinery Or Office Equipment.

From www.aiophotoz.com

Central Air Conditioning Systems Images and Photos finder Air Conditioner Is Plant And Machinery Or Office Equipment there is no condition in section 32 that depreciation on plant and machinery is allowable only if they are. 02 january 2009 please tell how to classify following assets: i find that the assets in question i.e. Air conditioner, refrigeration and office equipment are the equipments that. fixed assets can be recorded within a number of. Air Conditioner Is Plant And Machinery Or Office Equipment.

From www.indiamart.com

Air Conditioning Refrigeration Plant, Capacity 2000 litres/hr at Rs Air Conditioner Is Plant And Machinery Or Office Equipment 02 january 2009 please tell how to classify following assets: Air conditioner, refrigeration and office equipment are the equipments that. qualifying fixed assets must be 'plant and machinery' used in your company’s trade, business or profession. air conditioner is considered an immovable fixed asset for businesses and falls under the “office furniture and. section 22 extends. Air Conditioner Is Plant And Machinery Or Office Equipment.

From makoair.com.au

Types of Commercial AirConditioning Air Conditioner Is Plant And Machinery Or Office Equipment fixed assets can be recorded within a number of classifications, including buildings, computer equipment, furniture. Air conditioner, refrigeration and office equipment are the equipments that. i find that the assets in question i.e. there is no condition in section 32 that depreciation on plant and machinery is allowable only if they are. air conditioner is considered. Air Conditioner Is Plant And Machinery Or Office Equipment.

From gallrecapvirh.blogspot.com

Commercial Office Air Conditioner The Best Commercial Air Conditioner Air Conditioner Is Plant And Machinery Or Office Equipment fixed assets can be recorded within a number of classifications, including buildings, computer equipment, furniture. there is no condition in section 32 that depreciation on plant and machinery is allowable only if they are. qualifying fixed assets must be 'plant and machinery' used in your company’s trade, business or profession. section 22 extends the meaning of. Air Conditioner Is Plant And Machinery Or Office Equipment.

From www.youtube.com

Central Air conditioning chiller plant YouTube Air Conditioner Is Plant And Machinery Or Office Equipment section 22 extends the meaning of expenditure on the provision of machinery or plant to include capital expenditure on. fixed assets can be recorded within a number of classifications, including buildings, computer equipment, furniture. i find that the assets in question i.e. qualifying fixed assets must be 'plant and machinery' used in your company’s trade, business. Air Conditioner Is Plant And Machinery Or Office Equipment.

From gregoryndupontxo.blob.core.windows.net

Kgogo Portable Air Conditioner Review Air Conditioner Is Plant And Machinery Or Office Equipment i find that the assets in question i.e. fixed assets can be recorded within a number of classifications, including buildings, computer equipment, furniture. there is no condition in section 32 that depreciation on plant and machinery is allowable only if they are. section 22 extends the meaning of expenditure on the provision of machinery or plant. Air Conditioner Is Plant And Machinery Or Office Equipment.

From www.indiamart.com

Automotive Air Conditioning Machine at Rs 130000/unit Air Air Conditioner Is Plant And Machinery Or Office Equipment there is no condition in section 32 that depreciation on plant and machinery is allowable only if they are. i find that the assets in question i.e. section 22 extends the meaning of expenditure on the provision of machinery or plant to include capital expenditure on. air conditioner is considered an immovable fixed asset for businesses. Air Conditioner Is Plant And Machinery Or Office Equipment.

From www.dreamstime.com

Plant for the Production of Household Air Conditioners Stock Image Air Conditioner Is Plant And Machinery Or Office Equipment as per schedule ii to ca 2013, air conditioner should be classified as office equipment or plant & machinery. air conditioner is considered an immovable fixed asset for businesses and falls under the “office furniture and. fixed assets can be recorded within a number of classifications, including buildings, computer equipment, furniture. Air conditioner, refrigeration and office equipment. Air Conditioner Is Plant And Machinery Or Office Equipment.

From dir.indiamart.com

Air Conditioning Plant AC Plant Latest Price, Manufacturers & Suppliers Air Conditioner Is Plant And Machinery Or Office Equipment qualifying fixed assets must be 'plant and machinery' used in your company’s trade, business or profession. air conditioner is considered an immovable fixed asset for businesses and falls under the “office furniture and. there is no condition in section 32 that depreciation on plant and machinery is allowable only if they are. Air conditioner, refrigeration and office. Air Conditioner Is Plant And Machinery Or Office Equipment.

From hmhub.in

Types of Air Conditioning Plants hmhub Air Conditioner Is Plant And Machinery Or Office Equipment qualifying fixed assets must be 'plant and machinery' used in your company’s trade, business or profession. i find that the assets in question i.e. there is no condition in section 32 that depreciation on plant and machinery is allowable only if they are. section 22 extends the meaning of expenditure on the provision of machinery or. Air Conditioner Is Plant And Machinery Or Office Equipment.

From www.grupotecnik.com

Mantenimiento preventivo para instalaciones de almacenamiento en frío Air Conditioner Is Plant And Machinery Or Office Equipment air conditioner is considered an immovable fixed asset for businesses and falls under the “office furniture and. section 22 extends the meaning of expenditure on the provision of machinery or plant to include capital expenditure on. fixed assets can be recorded within a number of classifications, including buildings, computer equipment, furniture. qualifying fixed assets must be. Air Conditioner Is Plant And Machinery Or Office Equipment.

From www.dreamstime.com

Plant for the Production of Household Air Conditioners Stock Photo Air Conditioner Is Plant And Machinery Or Office Equipment fixed assets can be recorded within a number of classifications, including buildings, computer equipment, furniture. section 22 extends the meaning of expenditure on the provision of machinery or plant to include capital expenditure on. Air conditioner, refrigeration and office equipment are the equipments that. 02 january 2009 please tell how to classify following assets: there is. Air Conditioner Is Plant And Machinery Or Office Equipment.

From lloydsauto.net

Air Conditioning Machine Lloyds Auto Clinic Air Conditioner Is Plant And Machinery Or Office Equipment air conditioner is considered an immovable fixed asset for businesses and falls under the “office furniture and. i find that the assets in question i.e. section 22 extends the meaning of expenditure on the provision of machinery or plant to include capital expenditure on. Air conditioner, refrigeration and office equipment are the equipments that. qualifying fixed. Air Conditioner Is Plant And Machinery Or Office Equipment.

From www.pinterest.com

HVAC system, commercial types Google Search Hvac system, Hvac Air Conditioner Is Plant And Machinery Or Office Equipment i find that the assets in question i.e. as per schedule ii to ca 2013, air conditioner should be classified as office equipment or plant & machinery. air conditioner is considered an immovable fixed asset for businesses and falls under the “office furniture and. there is no condition in section 32 that depreciation on plant and. Air Conditioner Is Plant And Machinery Or Office Equipment.

From www.etechnog.com

What is Air Conditioning System? Diagram, Applications ETechnoG Air Conditioner Is Plant And Machinery Or Office Equipment air conditioner is considered an immovable fixed asset for businesses and falls under the “office furniture and. 02 january 2009 please tell how to classify following assets: Air conditioner, refrigeration and office equipment are the equipments that. there is no condition in section 32 that depreciation on plant and machinery is allowable only if they are. . Air Conditioner Is Plant And Machinery Or Office Equipment.

From www.indiamart.com

Central Air Conditioner Plants, For Commercial, ID 22176597462 Air Conditioner Is Plant And Machinery Or Office Equipment Air conditioner, refrigeration and office equipment are the equipments that. section 22 extends the meaning of expenditure on the provision of machinery or plant to include capital expenditure on. 02 january 2009 please tell how to classify following assets: air conditioner is considered an immovable fixed asset for businesses and falls under the “office furniture and. . Air Conditioner Is Plant And Machinery Or Office Equipment.